Question: How can I get health insurance to show up in the correct place on the Sworn Financial Statement?

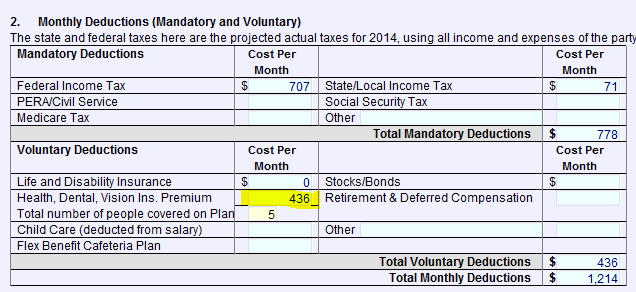

Answer: If the health insurance is a payroll deduction, it will appear in Section 2, as shown below:

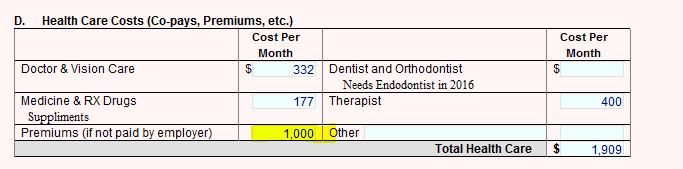

If it is NOT a payroll deduction, it will appear in section D of the personal expenses section of the SFS, as shown below:

It is the Tax Category that tells the software which it is.

You will see the Tax Category next to the entry where you enter the health insurance.

There are two places in the software where this can happen:

1. Income & expenses >Wages & Deductions, as shown below:

2. Income & expenses >Living Expenses, as shown below:

Select "Medical" to have the item carry do Section D as a personal expense. Otherwise, the item will carry to the top of the SFS as a Voluntary deduction from wages.

When you get to that line, click the help button for further explanation as to which tax category has which effect.